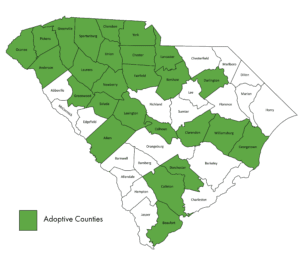

More than 20 South Carolina counties have adopted the standardized online filing of PT-100 with SC Department of Revenue. MyDORWAY is the SCDOR’s online platform for filing PT-100s.

Led by Past SCACPA Chair Ken Newhouse and others, SCACPA has been working with the South Carolina Department of Revenue and representatives of the state’s counties to streamline the filing of Business Personal Property (BPP) tax in South Carolina.

The counties highlighted in green have committed to transition to electronic BPP filing through MyDORWAY (click to enlarge).

Resolving the differences in filing processes among counties helps remove filing barriers and makes our state a better place for businesses. A major step forward was an agreement in 2020 with the counties agreeing to report on a common form, Form PT-100.

Several counties have adopted the process of filing the PT-100 electronically through MyDORWAY. The remaining counties still utilize different processes, including paper filings.

SCACPA is asking for your help to get counties to adopt the process of filing Form PT-100 electronically through the South Carolina Department of Revenue’s MyDOORWAY.

Specifically, if you know who to contact in your county to help us get the county to adopt the electronic filing process, let us know. This could be the County Auditor, Treasurer or Council Member.

If you can help, please contact us at membership@scacpa.org or call 803.791.4181.

For decades, Business Personal Property Tax compliance required split filings: retail businesses filed property tax returns with the state, all other businesses filed their property tax returns with the county. On top of that, many counties had different types of forms, with some being online, others being electronic, and a handful that would fax you the form each year. When you consider that South Carolina has 46 counties, this mix of processes added to a confusing burden for new businesses coming into the state and in-state businesses wishing to expand into other counties.

Positive change began about 10 years ago when a Greenville auditor who was technologically innovative had the foresight to successfully work with the state to have all BPP taxes filed with the South Carolina Department of Revenue. Filing with the DOR as a single point for all counties did not change the assessment amount or even how much a county would receive. It simply allowed for one form and one single place to file. All

amounts filed with the SCDOR would be transferred to the county electronically.

SCACPA supported the Department when it introduced legislation to have all filings completed electronically through the SCDOR website through one common form. The dual aims were to simplify the burden of filing in multiple locations and in a standardized format. This effort met headwinds from associations that represented counties and municipalities.

After years of testimony and advocacy work, in 2020, we agreed with the counties for a single form – the PT-100 – to be used in filing the BPP and that assessments would be determined by the SCDOR. That bill was signed into law. At that time, only eight counties had signed up to have all filings with SCDOR.

WHO TO CALL AT THE SCDOR ABOUT BPP

If you have questions about filing BPP, contact the SCDOR at 803.898.7700 or BPP@dor.sc.gov

The SCDOR’s Business Personal Property page can be found at Business Personal Property (sc.gov).

Instructions on how to file BPP through MyDORWAY can be found at BPP MyDORWAY Upload Instructions (sc.gov).