The compression of the CPA pipeline is an issue of state and national concern. SCACPA and societies in other jurisdictions and national organizations are continuously exploring avenues to relieve the compression and enhance the profession’s attractiveness to would-be CPA candidates and students.

To secure tomorrow, we must plan today. Futureproofing our profession means ensuring we remain relevant in an ever-shifting financial landscape. Further, in a world where change is the only constant, flexibility isn’t just an advantage; it’s a necessity.

So, how do we ensure a steadfast future and continued relevance for the CPA profession? Threats we must consider include opportunity and tuition costs, starting salaries, branding and reputation, population decline, and more.

Dynamic adaptation is key to ensuring the profession’s sustainability and growth. CPAs are guardians of the public interest, entrusted to uphold integrity and trust. So, we as a profession must tackle these challenges head-on.

In South Carolina, the revisions to Title 40 Chapter 2 (the law that regulates the accounting profession in South Carolina) enacted in 2022 removed several barriers to licensure. SCACPA also continues to foster relationships with colleges, universities, and firms to encourage and support students and CPA candidates along the licensure path. These support mechanisms include networking opportunities, scholarships, student debt relief, and CPA Exam Bonuses. SCACPA’s advocacy and growth efforts sow the seeds for future success. Many thanks to our volunteers and elected officials who understand the importance of the profession’s relevance and growth.

We invite you to attend one of the upcoming Professional Issues Updates during the SCACPA Roadshow. You’ll learn more about these and other pipeline initiatives and have an opportunity to ask your questions.

SCACPA’s Legislative Proposal

The CPA profession is truly distinct in the licensing spectrum. While it’s governed at the state level, it grants nationwide practice rights. This blend of local and national jurisdictions shapes the backdrop against which we’re introducing amendments to Title 40, Chapter 2.

You can view SCACPA’s proposed amendments to the Practice Act below. The document includes in-line changes and comments describing the reasons behind the updates. Additionally, you’ll find an in-depth analysis of the Uniform Accountancy Act that provides specialized insight into the Act and other state laws.

Key Aims of the Legislative Update:

- Flexibility in Licensing Framework: In today’s ever-shifting economic and professional scenes, our licensing framework should be versatile and able to pivot as external circumstances change.

- Guarding Professional Integrity: The South Carolina Board of Accountancy (SC BOA) should oversee any CPA serving South Carolina’s residents, ensuring top-tier professional ethics and safeguarding our citizens’ interests.

- Precision & Clarity: We’re correcting small content and citation issues. This is key to ensuring the law’s language is crystal clear and straightforward.

The Process Behind the Proposals:

Crafting these proposals wasn’t a snap decision. Our task force dove deep into research, consulted with several stakeholders, and reflected seriously on the path ahead. We understand any statute changes have an effect on the profession and the public.

Summary of Proposed Changes:

- Refine the definition of Substantial Equivalency as a determination by the Board of Accountancy that another jurisdiction’s licensing statutes and administrative rules are comparable to or exceed this State’s requirements. This proposal broadens the definition while preserving the fundamental objectives laid out in Appendix B of the UAA.

- Amend existing statutes to clarify the nature of educational programs and the Board of Accountancy’s power to adopt them. The intention is to protect workforce development so South Carolina can attract skilled professionals in case five or more states choose to modify their educational requirements. This empowers the board to approve up to 30 hours of educational credit derived from non-accredited sources (aka “pizza toppings”) such as experiential learning, certificates, and alternative educational programs.

- Expand the CPA Exam window from 18 to 36 months.

- Update Reciprocity to allow the Board to issue a reciprocal license to a CPA possessing an active certificate/license/permit to practice from any jurisdiction, regardless of that jurisdiction’s substantial equivalency status. This ensures any CPA with an active license can obtain a South Carolina CPA license without additional burden placed on the applicant or the Board of Accountancy staff.

- Update Mobility requirements so the Board of Accountancy can maintain jurisdictional authority (and safeguard citizens) over CPAs exercising mobility, even if their home jurisdiction loses its status of substantial equivalency. Because there is a trend among jurisdictions of broadening access to CPA qualifications for non-traditional candidates, there is a chance those jurisdictions could lose their substantial equivalency status. This update ensures the South Carolina Board is equipped to maintain oversight of CPAs from those jurisdictions practicing in the State.

Thank you to our legislative task force members for the time and dedication in reviewing the statute, suggesting and vetting the amendments, engaging in meaningful conversations, and helping to secure the future of the CPA profession.

As a member, your voice matters. If you have questions or comments regarding the proposed amendments or the analysis, please contact SCACPA CEO Chris Jenkins.

The 120 vs. 150 Hours Discussion

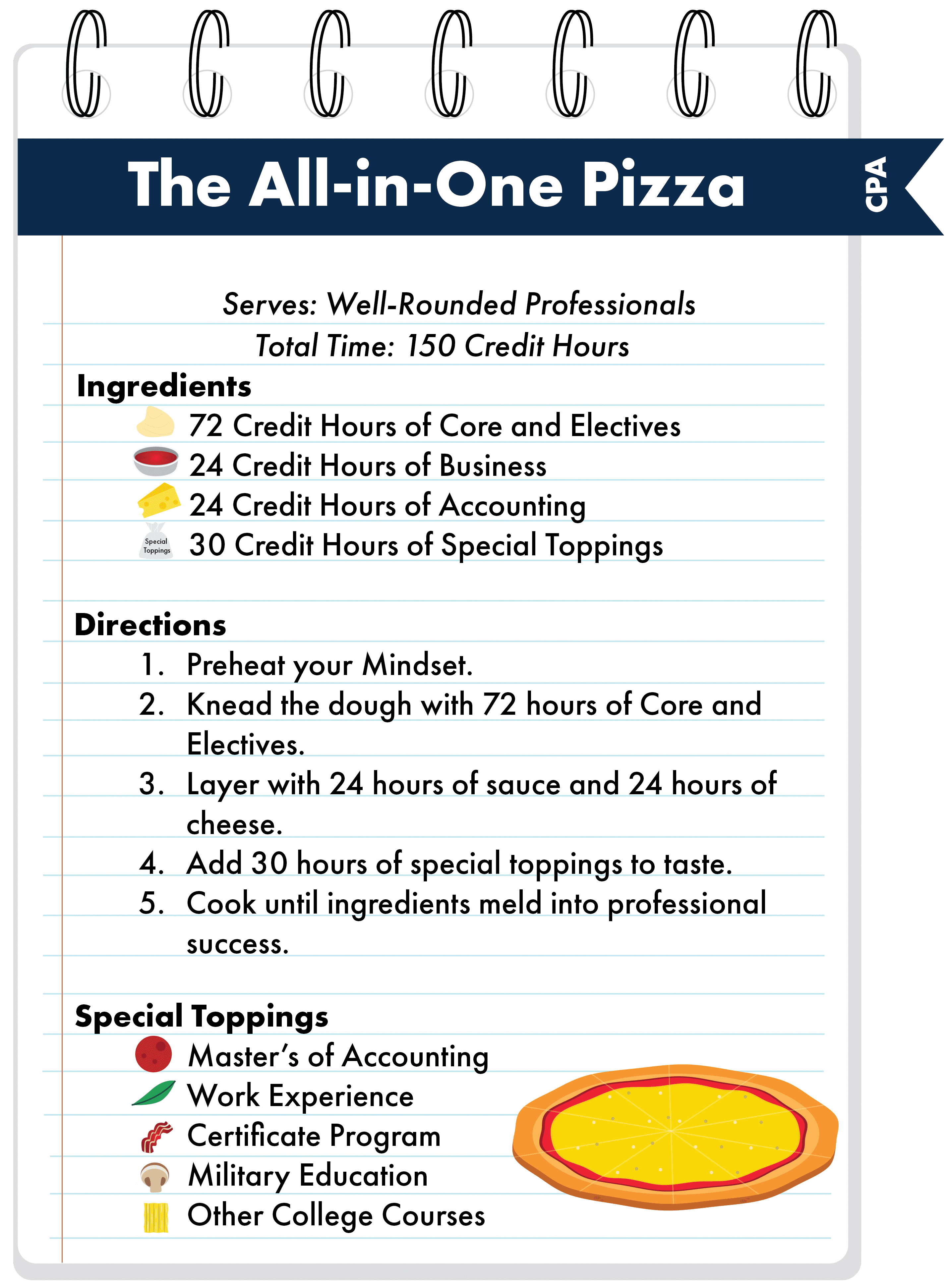

Imagine you’re with a group of friends or your family, and you want to order some pizza for the evening. You all agree that pizza sounds good, but everyone wants different toppings. Everyone orders the pizza with the toppings that meet their needs and preferences, and by the end of the meal, everyone is full and happy. Everyone had the same foundational ingredients of crust, sauce, and cheese but chose their variable toppings based on what they felt would best satisfy their cravings and hunger.

What does this have to do with CPA education and licensure?

Imagine the educational requirement like a pizza. The crust represents the foundational knowledge, the sauce the core accounting classes, and the cheese the essential business courses. These three parts total around 120 hours or a bachelor’s degree.

Like pizza toppings, the 30 hours could be fulfilled through various educational combinations, encapsulating the vision of a “Well-Rounded Professional.” This means something different for everyone.

Other professions value credentialing programs or certificates as authentic education, especially in technology.

The 30 hours are intentionally undefined. As the educational landscape evolves, non-traditional forms of learning are gaining importance. Can varied modes of non-transcript education contribute to crafting well-rounded professionals?