CPA EVOLUTION UPDATE: WHAT IS THE IMPACT ON YOU?

This week SCACPA leadership attended a meeting of the South Carolina Board of Accountancy Education Subcommittee. In addition to SCACPA leadership, the meeting was attended by BOA members and representatives of most colleges and universities in South Carolina that offer undergraduate and/or graduate accounting programs.

A major order of business was a discussion of the impact of the new CPA Licensure Model, known as “CPA Evolution,” on South Carolina colleges and universities as they prepare our accounting students for CPA licensure.

In addition, SCACPA CEO Chris Jenkins led a discussion on proposed changes to SC statues related in significant part to the educational requirements of the CPA credential and the academic preparation of the future CPA.

As part of representing our CPA members, SCACPA is working to address needs of South Carolina CPAs both through efforts with our South Carolina colleges and universities and with our legislators to update certain state laws governing the profession.

If you are not familiar with the CPA Evolution Initiative, we provide an introduction to this important issue below, as well as its direct impact on our state’s accounting educators and regulations governing the profession.

CPA EVOLUTION INITIATIVE

The CPA profession is changing. This evolution is requiring deeper, and in some ways different, skill sets. To address this the AICPA Governing Council and the NASBA Board of Directors have both voted to support a new CPA licensure model, including a new Uniform CPA Examination® beginning in 2024.

This joint initiative is named “CPA Evolution” and is described by AICPA/NASBA as, “A dynamic new approach to CPA Licensure that positions the profession for success now and in the future, and ensures public protection.”

WHAT IS CHANGING?

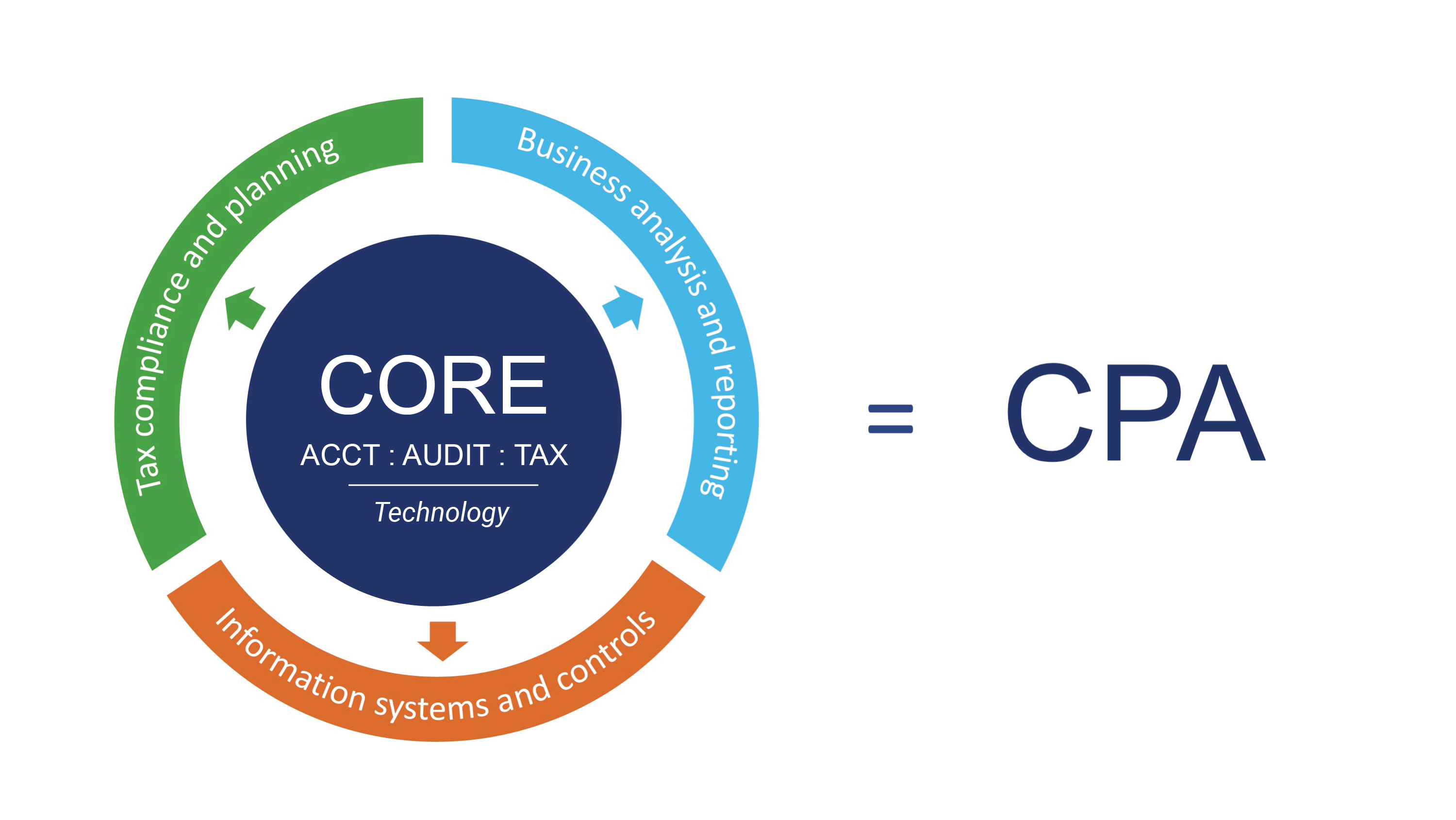

Among the changes, the CPA Evolution modifies the requirements of education and examination, with implementation of the new exam starting in 2024. The current four-part Uniform CPA Examination® of Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG) will be replaced by a Core + Discipline exam model.

According to AICPA, “The model starts with a deep and strong core in accounting, auditing, tax and technology that all candidates will be required to complete.” Then a candidate must choose one of three Disciplines: Tax compliance and planning; Business analysis and reporting; Information systems and controls.

Successfully completing the Core + Discipline exam model process will then lead to “full CPA licensure, with rights and privileges consistent with any other CPA. A discipline selected for testing does not mean the CPA is limited to that practice area.”

IMPACT ON SOUTH CAROLINA COLLEGES AND UNIVERSITIES

The CPA Evolution’s changes to the CPA License Exam do not take effect until 2024. However, they are already having impact on the future of the profession.

Today’s students are tomorrow’s CPAs. With the new exam starting in 2024, the changes will affect students who are already enrolled.

As part of our efforts to help sustain the pipeline of qualified candidates into the profession, we are helping lead the effort with representatives of South Carolina’s universities and colleges to make sure their academic curriculum meets the needs of a future CPA.

Within SCACPA membership we have our Campus Champions effort with designated on-campus leadership serving as a resource to aspiring CPAs. As well, we are working very closely with the South Carolina Association of Accounting Educators (SCAAE) to make sure the CPA profession is represented with that association and its activities.

IMPACT ON SC REGULATIONS

South Carolina laws include specific educational requirements that must be met for a candidate to be eligible for the CPA credential. With changes in the profession, including the CPA Evolution, we believe the CPA profession, clients and the public at large would benefit from updating certain statutes that govern the profession.

Therefore, and because of a multi-year effort by SCACPA and its leadership, proposed statutory changes have been introduced to the legislature.

If passed, these updates would (among other changes) align South Carolina’s statutory educational requirements for the CPA credential with the new CPA Evolution and be more flexible to future changes than the current regulatory framework.

Generally, the proposed changes would keep the requirement of 150 semester hours of education, but provide flexibility within that requirement for CPA Candidates to prepare fully for their chosen Discipline area of the new Core + Discipline Model.

For example, a student targeting the Information Systems and Controls Discipline could take courses to prepare for that Discipline and count those hours toward the overall academic requirement to earn the CPA credential.

As well, the nature of a student’s academic path is changing. Examples include that many more students are taking classes via remote learning and more are first attending a two-year program.

To help provide flexibility while maintaining high-standards for public protection, the proposed regulations would give the Board of Accountancy more discretion than under the current regulations in deciding what meets regulatory criteria of certain provisions.

CONCLUSION

While the CPA Evolution Initiative is designed to help the CPA profession respond to the changing demands on the profession, it is also itself creating change to the profession. As your advocate in South Carolina, we will continue to advocate for the CPA profession and lead in major efforts that affect you.

The current four-part Uniform CPA Examination® of Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG) will be replaced by a Core + Discipline exam model beginning in 2024.